SPECIAL FOCUS - 2020 United States Presidential Election Aline Beckers, Marketing – Commercial & Asset Management Support Officer, 2020-11-03

Besides surging number of hospital admissions due to covid and underlying containment measures, the US presidential election is of course THE topic of the week. If the outcome of the presidential elections of 2016 (but also the covid crisis we are going through) taught us never to say never or to never base ourselves on any certainty, the main stake of these elections will be above all to have a clear winner…

Tomorrow morning, we should know who will become the 46th president of the world’s leading power for the next 4 years.

So let us focus on this Big Event …

#D-DAY

Trump? Biden? Any issue is still possible and we are not going to get into hazardous predictions…

In fact the main stake of these elections will be above all to wake up tomorrow morning with a clear outcome on the winner of the elections (the risks are: tight results, angry Donald Trump and rejection of election results, vote counting not finished, bug in the last votes by correspondence; these risks would be the big triggers of market volatility).

To deal with the significant risk of overly tight results, everything seems to depend on these famous swing states.

And to help us understand the term swing states, we should only remember that it is the “Electors” forming the Electoral College that count in the nomination of the President of the United States... These representatives of the American people are responsible for electing the President and Vice-President. Each state has a predefined number of “Electors”, each affiliated with a particular candidate.

For each state, these “Electors” are allocated entirely to the pair of presidential and vice-presidential candidates who have won the most votes on Election Day (the "winner-take-all" method), with a few exceptions.

In the end, the Electoral College meets to elect the President and Vice-President by an absolute majority, i.e. 270 votes out of the 538.

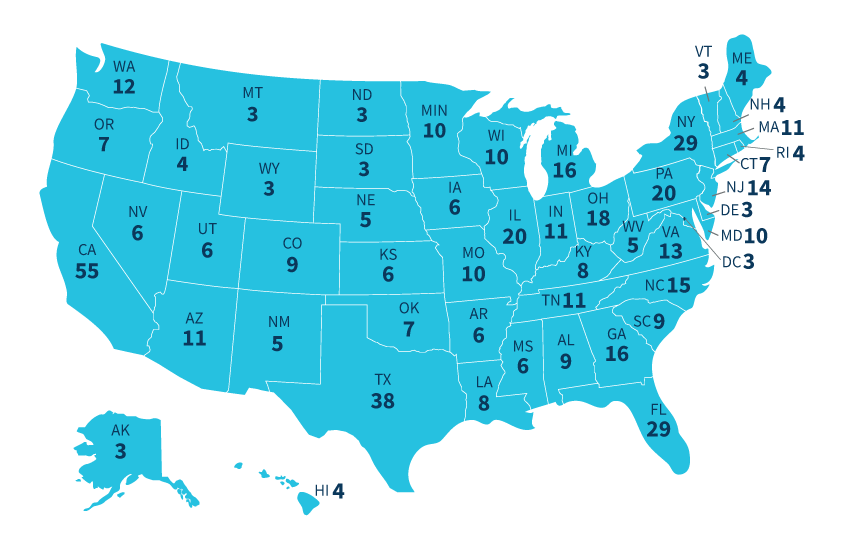

Above, the number of « Electors » for each State (538 in total) – source : www.usa.gov

Some of these states are clearly and historically “Red” or “Blue”. It is therefore easy to understand that the whole issue lies with the others, the “undecided”, those who can turn everything upside down … the Swing States. Currently, it appears that Biden “saved” the most electoral votes in his column, but the swing states can change everything. Among them: Texas (38 Electors), Florida (29 Electors), Pennsylvania (20 Electors), Michigan (16 Electors) and Wisconsin (10 Electors). Other “undecided” can be mentioned: Ohio (18 Electors), Georgia (16 Electors), North Carolina (15 Electors) or else Iowa (6 Electors).

AND WHAT’S NEXT ?

Once the results are disclosed (tomorrow morning in the “best case scenario”), the question obviously relates to the program of each candidate in order to deduce economic and financial impacts of one or other presidency. In their respective program:

DONALD TRUMP

In summary, Trump promised more tax cuts and less regulation "at levels never seen before". He also suggested that he would apply additional tariffs against China…

Corporate income tax

- Tax credit for businesses repatriating jobs from China

Income tax on individuals

- Unspecified tax cuts for middle-class households

- Capital gains tax cuts to 15%

The Fed

- Less independence from the Fed and probably increased direct pressure

- Call for the Fed to follow the other central banks

- Appointment of Judy Lynn Shelton? (highly skeptical about the Fed, Shelton called for a 0% inflation target, criticized the Fed's longstanding policy of independence from the White House, etc.

Finance

-

Trade

- “America First” program

- Preservation of a hard line with China, increased tariffs cannot be ruled out

Infrastructure

- Nothing announced while the 2016 program has not been reached yet …

- Marked deregulation in banking, finance, the energy sector and environment. Exception: the tech sector

Regulation

- Marked deregulation in banking, finance, the energy sector and environment. Exception: the tech sector

JOE BIDEN

In summary, Biden pledged to raise taxes on the richest people and businesses and to use that money to spend billions to upgrade infrastructure, move to a cleaner energy future, to make living and child care more affordable and to improve education.

Corporate income tax

- Increase in corporate tax rate from 21% to 28% (Trump lowered them from 35% to 21% during his mandate)

- 10% penalty for companies relocating abroad

- 10% tax credit for companies creating jobs

Income tax on individuals

- Increase in the rate for the “upper bracket” from 35% to 39.6%

- Taxation of capital gains and dividends as “ordinary income”

The Fed

- Return to a more traditional and separate approach to powers

Finance

- Taxes on financial transactions

Trade

- Getting closer to Europe again

- USD 400 billion increase in purchases of U.S. goods

- No short-term decrease in tariffs on Chinese goods

Infrastructure

- 2 trillion for bridges, roads, alternative energies, real estate, etc.

Regulation

- Tightening of regulations in particular on worker protection, banking, finance, the Environment and internet platforms

Source: Catallaxis Oct 2020, Les Cahiers Verts de l’Economie

Besides these programs and the name of the new President of the United States, the presidential election will occur simultaneously with the elections to the Senate and the House of Representatives. These are of utmost importance as the results will determine the ability of the elected President to get the various aspects of his program across.

Indeed, the President is very free for initiatives in areas such as international relationships and trade policy but much more dependent on Congress for tax reforms…

The story is far from over; on the contrary, this is where it all begins ...

Questions? Suggestions? Please contact us.

Disclaimer: The information above is provided for informational purposes only and serves to present ManCo Services activities of Pure Capital SA. The information provided herein (which includes the text and photos) is protected by copyright and any partial or total reproduction or distribution of this information is prohibited without the prior consent of Pure Capital S.A. (“Pure Capital”). Pure Capital reserves the right to modify or otherwise change the information provided in this document at any time and without prior notice.

This document must not under any circumstance be considered to be an offer to buy or sell a financial product or a solicitation of an offer to buy or sell an investment or asset management product. All of the information provided herein is of a descriptive nature and does not, under any circumstance, constitute investment advice. This information has not been prepared in accordance with legal requirements designed to promote the independence of investment research. It should therefore be considered as a marketing communication. Although this content is not subject to any prohibition on its use prior its dissemination (e.g. for trade executions), Pure Capital does not attempt to benefit from this situation for its own advantage.

Pure Capital shall not be liable for the information in this document, which is provided in good faith. There can be no guarantee that investment objectives will be met. Past performance is not a reliable indicator of future performance and performance may vary over time. The portfolio’s net market value depends on market trends. All portfolios are subject to market fluctuations and investors may not recover all of their initial investment. Your custodian may charge annual custody fees. Different custodians may charge different fees for their services. For more information about these fees you must contact the custodian.

This document is provided with the understanding that it shall not constitute a primary basis for investment.

Warning: Undefined array key "disclaimer" in /var/www/vhosts/purecapital.eu/httpdocs/wm-content/content_news.php on line 47